When you hire new employees, you need to collect information to verify employment eligibility and run payroll. Federal Forms W-4 and I-9 are just the beginning when it comes to new employee forms. You may also need to collect state-specific forms, including your state’s W-4. What is the state W-4 form?

State W-4s work similarly to the federal Form W-4, Employee’s Withholding Certificate. Employers use state W-4s to determine state income tax withholding for employees. States either use their own version of the state W-4 or the federal Form W-4. Unless your employees work in a state with no state income tax, they generally must fill out the W-4 state tax form before starting a new job.

Employees and employers use state W-4s to determine state income tax withholding." width="1741" height="861" />

Employees and employers use state W-4s to determine state income tax withholding." width="1741" height="861" />

Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington, and Wyoming do not have state income tax. Most other states require employees to complete the W-4 for state taxes, unless the state imposes a flat income tax rate.

Your employees’ information on the W-4 state form determines how much you will withhold from their wages for state income tax.

Many states use state withholding allowances to determine withholding. Employees can claim state tax allowances for themselves, a spouse, or child. The more state tax withholding allowances an employee claims on their state W-4, the less you withhold.

Most states update their W-4 forms annually. Visit your state’s website to verify you are using the most up-to-date state W-4 form.

After collecting your employees’ completed state W-4 forms, use them to determine how much to withhold when running payroll. Store employees’ state tax withholding forms in your records.

As an employer, you may need to withhold three types of income tax from employee wages, including federal, state, and local income taxes. You must distribute both federal and state Forms W-4 to employees so you can accurately run payroll. But, what’s the difference?

Employees use the federal Form W-4 for federal income tax withholding. Employees use their state’s version of Form W-4 for state income tax withholding. Some states let employers calculate an employee’s state income tax withholding based on the information they input on the federal Form W-4.

In 2020, the IRS released a new W-4 form that eliminated withholding allowances. However, many states still use withholding allowances for their state income tax structure.

Because of this change, some states that previously used the federal form for state income tax withholding have created their own version of Form W-4 (e.g., Idaho). States that continue to use the federal version made changes to their state income tax structure.

Here’s the bottom line: The 2020 version of the federal W-4 form may have done away with withholding allowances for federal income tax withholding. But, many states continue to use withholding allowances for state income tax withholding.

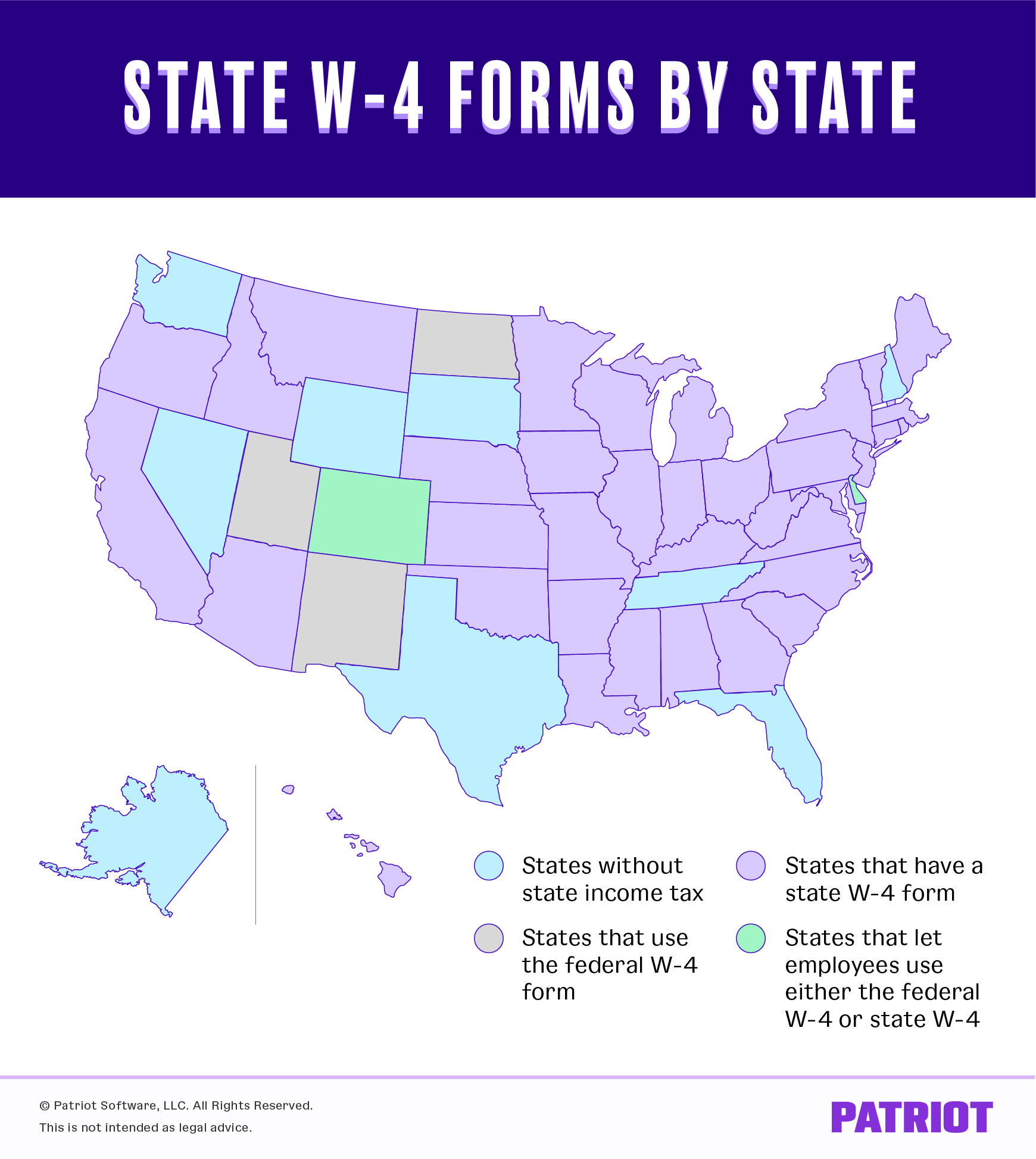

Here are the states that have created their own version of the state W-4 form rather than using the IRS’s updated version:

These are the states that will continue to use the federal W-4 form:

without state income tax, states that use the federal W-4 form, states that have a state W-4 form, and states that let employees use either the federal or state W-4 form" width="1740" height="1947" />

without state income tax, states that use the federal W-4 form, states that have a state W-4 form, and states that let employees use either the federal or state W-4 form" width="1740" height="1947" />

You cannot accurately run payroll until you know how much to withhold for state income tax. Use this chart to learn which state W-4 form you need to distribute to and collect from new hires.

| State | State W-4 Forms |

|---|---|

| Alabama | Form A-4, Employee’s Withholding Tax Exemption Certificate |

| Alaska | N/A, no state income tax |

| Arizona | Arizona Form A-4, Employee’s Arizona Withholding Election |

| Arkansas | Form AR4EC, State of Arkansas Employee’s Withholding Exemption Certificate |

| California | Form DE 4, Employee’s Withholding Allowance Certificate |

| Colorado | Form DR 0004, Colorado Employee Withholding Certificate |

| Connecticut | Form CT-W4, Employee’s Withholding Certificate |

| D.C. | Form D-4, Employee Withholding Allowance Certificate |

| Delaware | Delaware W-4, Employee’s Withholding Allowance Certificate |

| Florida | N/A, no state income tax |

| Georgia | Form G-4, State of Georgia Employee’s Withholding Allowance Certificate |

| Hawaii | Form HW-4, Employee’s Withholding Allowance and Status Certificate |

| Idaho | Form ID W-4, Employee’s Withholding Allowance Certificate |

| Illinois | Form IL-W-4, Employee’s and other Payee’s Illinois Withholding Allowance Certificate and Instructions |

| Indiana | Form WH-4, Employee’s Withholding Exemption and County Status Certificate |

| Iowa | Form IA W-4, Employee Withholding Allowance Certificate |

| Kansas | Form K-4, Kansas Employee’s Withholding Allowance Certificate |

| Kentucky | Form K-4, Kentucky’s Withholding Certificate |

| Louisiana | Form L-4, Employee Withholding Exemption Certificate |

| Maine | Form W-4ME, Maine Employee’s Withholding Allowance Certificate |

| Maryland | Form MW507, Employee’s Maryland Withholding Exemption Certificate |

| Massachusetts | Form M-4, Massachusetts Employee’s Withholding Exemption Certificate |

| Michigan | Form MI-W4, Employee’s Michigan Withholding Exemption Certificate |

| Minnesota | Form W-4MN, Minnesota Employee Withholding Allowance/Exemption Certificate |

| Mississippi | Form 89-350-20-8-1-000, Mississippi Employee’s Withholding Exemption Certificate |

| Missouri | Form MO W-4, Employee’s Withholding Certificate |

| Montana | Form MW-4, Montana Employee’s Withholding Allowance and Exemption Certificate |

| Nebraska | Form W-4N, Employee’s Nebraska Withholding Allowance Certificate |

| Nevada | N/A, no state income tax |

| New Hampshire | N/A, no state income tax |

| New Jersey | Form NJ-W4, Employee’s Withholding Allowance Certificate |

| New Mexico | Form W-4, Employee’s Withholding Certificate |

| New York | Form IT-2104, Employee’s Withholding Allowance Certificate |

| North Carolina | Form NC-4, Employee’s Withholding Allowance Certificate |

| North Dakota | Form W-4, Employee’s Withholding Certificate |

| Ohio | Form IT-4, Employee’s Withholding Exemption Certificate |

| Oklahoma | Form OK-W-4, Employee’s Withholding Allowance Certificate |

| Oregon | Form OR-W-4, Oregon Employee’s Withholding Statement and Exemption Certificate |

| Pennsylvania | N/A, everyone pays a flat rate unless exempt |

| Rhode Island | RI W-4, State of Rhode Island Division of Taxation Employee’s Withholding Allowance Certificate |

| South Carolina | SC W-4, South Carolina Employee’s Withholding Allowance Certificate |

| South Dakota | N/A, no state income tax |

| Tennessee | N/A, no state income tax |

| Texas | N/A, no state income tax |

| Utah | Form W-4, Employee’s Withholding Certificate |

| Vermont | Form W-4VT, Employee’s Withholding Allowance Certificate |

| Virginia | Form VA-4, Employee’s Virginia Income Tax Withholding Exemption Certificate |

| Washington | N/A, no state income tax |

| West Virginia | Form WV/IT-104, West Virginia Employee’s Withholding Exemption Certificate |

| Wisconsin | Form WT-4, Employee’s Wisconsin Withholding Exemption Certificate/New Hire Reporting |

| Wyoming | N/A, no state income tax |

*Some states may require additional forms for special circumstances. For example, Pennsylvania requires that new hires complete the Residency Certification Form. Check with your state for more information.

Enjoy instant payroll tax calculations when you use Patriot’s award-winning payroll software.

Your employees may want to adjust their withholding on their state W-4 form after completing the original form. For example, an employee may get married or divorced, add or remove a dependent, or go through another life event that affects their withholding.

Employees can update their state tax withholding forms throughout the year. Be sure to collect their updated state tax forms for your records and adjust your payroll.

Each year, you are responsible for reporting how much you paid employees and withheld from their wages for income and payroll taxes when filling out W-2, Wage and Tax Statement.

Boxes 15-17 on Form W-2 deal with your state. Report how much you withheld and remitted for state income tax in Box 17. Again, the amount you withheld for the year is typically based on the employee’s state W-4 form.

If your employees work in a state with state income tax, you need to collect state W-4 forms and store them in your records. Keep a copy in the cloud with Patriot’s online HR software. The HR software integrates with our online payroll. Try both for free today!

This article has been updated from its original publication date of December 31, 2018.

This is not intended as legal advice; for more information, please click here.